UK property news headlines offer a mixed bag of hot topics for homeowners, landlords and tenants alike.

Subjects range from tenants’ desiring homes with good energy efficiency standards and a “house of horrors” let by one rogue landlord, to the latest House Price Index and views on the apparent stability in the housing market. Plus, a report says that tenants prefer an “all-inclusive” rent that includes utility bills.

Good EPC Ratings Increasingly Important For Renters

Uncertainties about steadily rising energy costs are likely to worry all householders.

That may be one of the principal reasons why good Energy Performance Certificate (EPC) ratings have become such a priority for tenants in search of their next rented property.

Landlord Today on the 9th of March cites a recent survey where 78% of tenants made a good EPC a priority when considering where to rent. If that is the case, says the article, landlords need to start making energy-efficiency improvements. Only 53% of dwellings in the private rented sector currently achieve an EPC of C or above. But 94% of them are suitable for upgrading.

“House Of Horrors” Landlord Ordered To Pay Thousands Of Pounds

On the 6th of March Barking and Dagenham Council in London reported on the successful prosecution of an unscrupulous landlord whose let property had become a “house of horrors”.

The courts fined the owner of the property a total of £6,000, plus a further £2,000 victim surcharge, and £335 costs.

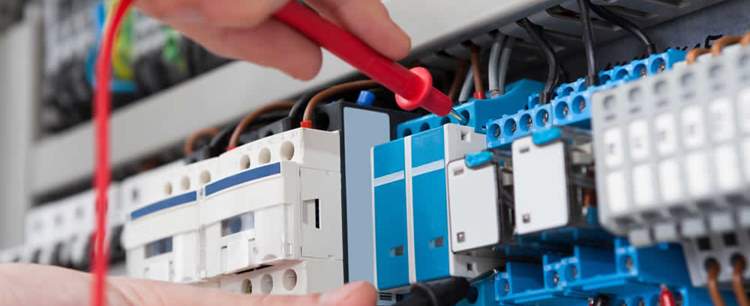

Details about the rundown and unsanitary condition of the property included broken doors and windows, water leakage, infestations of cockroaches and rats, dangerous electrical wiring, and a lack of fire safety measures and precautions.

The London Borough of Barking and Dagenham operates a council-wide system of licensing for landlords of all let property. A council spokesman added that landlords who put “profits before people” will not be tolerated.

The Latest Halifax House Price Index

The latest House Price Index for February from the Halifax suggests that average house prices across the UK have become more or less stable.

A relatively small monthly increase in prices of 1.1% from January to February 2023 means that the average price of a home is now £285,476. That is a 2.1% increase in the 12 months to the end of February.

That stability has been encouraged, says the Halifax, by the latest lowering of mortgage interest rates, growing consumer confidence in the economy, and a robust labour market.

Despite the current stability, though, the general trend is downwards. Average prices have now fallen by 2.9% since their record high in August 2020. Even so, this still puts them nearly £9,000 higher than at the beginning of 2022. Prices continue to be higher than they were immediately before the pandemic.

UK House Prices Could Be Stabilising Despite Falls, Say Surveyors

The overall picture of more or less stable prices in the housing market is echoed by the Royal Institution of Chartered Surveyors (RICS), says a story in the Guardian newspaper on the 9th of March.

The optimism expressed by RICS was borne out by both inquiries from new buyers and the house sales transactions completed in February – activity that seems to have been inspired by lower than anticipated mortgage interest rates.

The past imbalance between high demand and limited supply has been corrected somewhat as more homes come onto the market. Buyers, therefore, have a greater choice now than at probably any other time in the past 24 months. Nevertheless, the time taken to complete the purchase of a house has risen to a current 19 weeks.

Renting: Tenants Seek ‘Bills Included’ Homes As Energy Costs Rise

A further story illustrating the concerns of tenants about rising energy prices is reported by the BBC.

The article describes how tenants are placing much greater emphasis on rents that are “all-inclusive” in so far as the payment of utility bills is included. “Bills included” has become the second most frequent search term used by prospective tenants – whereas that term was only the fourth most important this time last year.

An all-inclusive rent will relieve you of the need to deal with energy suppliers, but there still could be downsides. It may be difficult to work out whether the charge included in the rent by the landlord represents good value for money. By paying an all-inclusive rent, you are also prevented from saving money by curbing your energy consumption. Plus, the landlord may set a cap on the amount of energy used which is included within the rent, so there is still a worry over bills.