A new study reveals that homeowners have benefitted from a 1.2% drop in average home insurance premiums in the past year – despite rising subsidence claims.

Data from analytics firm Consumer Intelligence shows that across the market, average overall premiums sit at £134.

The research also highlights that:

- the under-50s have benefitted from the biggest price drop this year at 1.7%, bringing average premiums to £139;

- premiums for the over-50s have seen a slight drop of 0.6%, with the average landing at £128;

- homeowners in the North East enjoy the lowest cost home insurance, with average prices of £116 per year;

- an average London homeowner pays the most for their home insurance at £176 – despite seeing one of the largest reductions in the cost of cover in the past year (-2.1%);

- properties built before 1895 are still the most expensive to insure, with an average premium of £152. However, increasing renovations of older properties has shrunk claims costs, with the past 12 months seeing price reductions of 3.8%;

- properties built in the millennium have enjoyed an average 1.3% drop in home insurance premiums – likely attributed to new properties being fitted with latest technology and more modern and effective locks – deterring thieves.

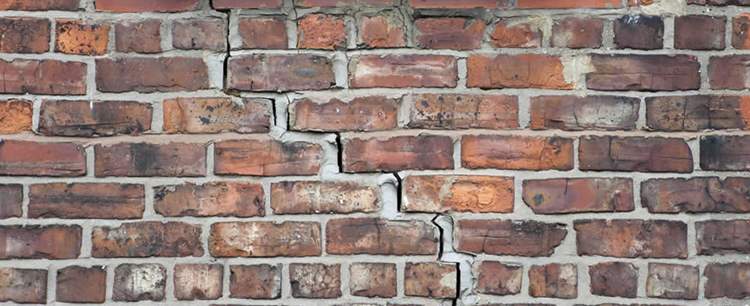

A spokesman from the company said: “While shifts in premiums over the past year have not been huge, it remains a competitive marketplace. Despite rises in subsidence and escape of water claims, customers have benefitted from stable pricing across the board”.